TALLAHASSEE, Fla. — Gov. Ron DeSantis signed a bill that would require sales tax to be collected on all in-person and online sales into law late Monday night.

What You Need To Know

- SB 50 would require sales tax on all online sales, regardless of whether the business has a physical presence in the state

- Estimated to generate nearly $1 billion in revenue a year

- Republicans want to use the money to replenish the unemployment trust fund

- FLORIDA GOVERNMENT GUIDE: Latest News, Contact Your Lawmakers and More

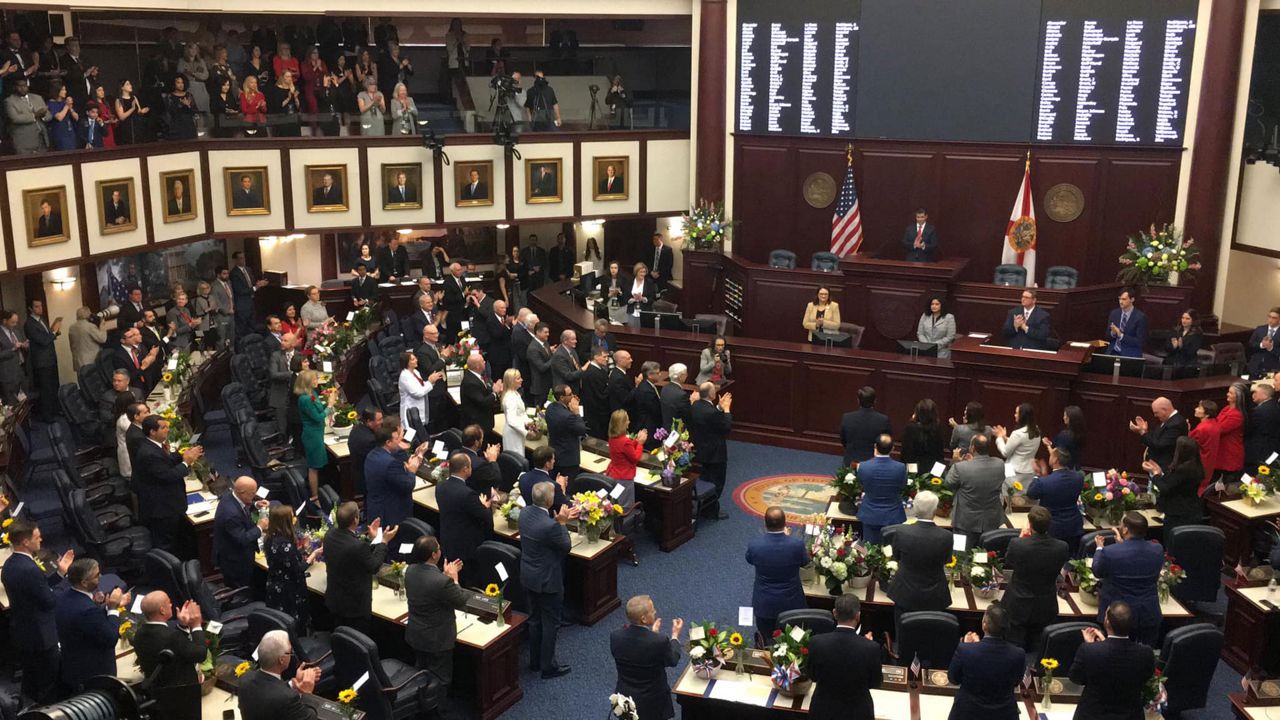

The Florida Legislature sent CS/SB 50 to the governor's office on Monday.

Current law online requires sales tax collection from businesses with a physical presence in Florida.

An example of the impact includes Amazon. For years Amazon never collected online sales tax, but when they opened their first distribution center in Florida, they then had a physical presence and was required to collect sales tax.

There are varied arguments to the impact of the bill.

Florida Democrats argue it will level the playing field, where out-of-state online retailers will ultimately have the same price as brick and mortar and Florida-based online shops. Democrats in the past wanted to use the nearly $1 billion in annual revenue it is estimated to generate to fund specific programs and efforts.

Florida Republicans argued in the past it was essentially a tax increase. Then during this session the Republican-controlled Legislature opted to push ahead with the idea, using the revenue to replenish the state's depleting unemployment trust fund.

The argument Republicans make is that it would save businesses who pay taxes to fund the state's unemployment trust fund.